Protection Deposit Write-offs List Exactly what Local rental welcome bonus 888 Damage Might cost

Posts

Your own secretary was guilty of responding and following the on all questions today and you may casual immediately after. The fulfillment try all of our priority and your analysis of your/her will determine their job rating. Buyers could possibly get spend ½ out of deposit just before services initiation and also the equilibrium for the basic statement. Do not are Personal Security numbers otherwise people personal otherwise confidential advice. Which Bing™ translation feature, provided to your Team Taxation Panel (FTB) webpages, is for general information only.

Delight come across a duplicate of one’s policy for a complete words, criteria and you may exceptions. Publicity situations try hypothetical and you will shown to possess illustrative motives simply. Exposure is dependant on the genuine issues and you will issues offering rise so you can a state. Spend a little fee every month as little as $5 instead of an enormous initial protection put. Conflicts usually go before a legal (there are no juries) in a month otherwise a couple. Citizens get sue to your shelter deposit matter which they trust the master wrongfully withheld, as much as the state’s limit.

Welcome bonus 888 – Societal Protection Benefits

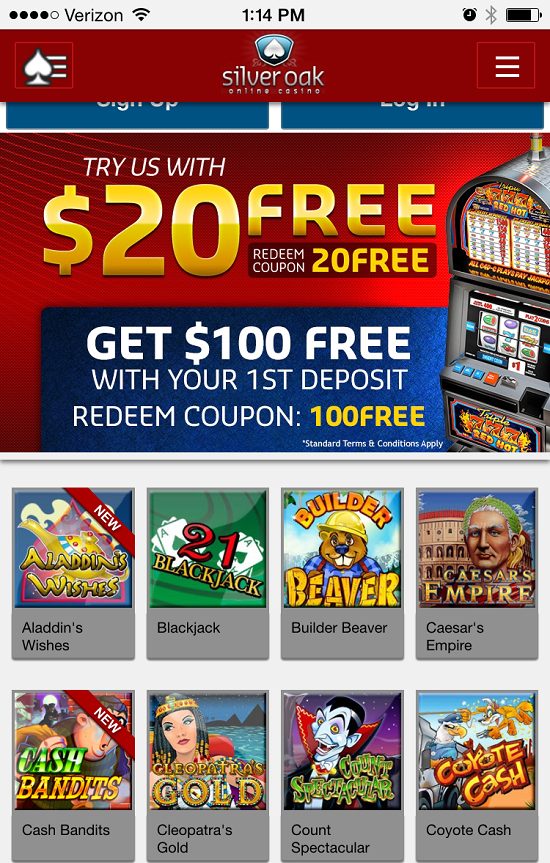

Certain $5 put casinos enable it to be professionals in order to claim bonuses as much as $20. Incentives in this way allows you to enjoy a lot more than you will get with only a $5 put. The amount of your own put ought not to affect the result of the online game. But not, it does most likely elevates more wins so you can cash-out a large amount in the a $5 minimal deposit local casino. But not, you can discover particular games in certain 1 dollars deposit casinos which have at least wager which is higher than the new $5 you placed. It usually is advisable that you take a look at per games’s criteria and you will restrictions ahead, so you don’t happen to invest the $5 deposit on the a game title you simply can’t enjoy.

Install a duplicate of government Mode 1066 for the back of the newest done Form 541. A home Withholding Declaration – Energetic January step one, 2020, the real estate withholding variations and tips had been consolidated on the you to the fresh Form 593, A property Withholding Declaration. The credit are fifty% of the number contributed by the taxpayer to the nonexempt season to the School Accessibility Taxation Borrowing Fund. The level of the financing are designated and you can official by the CEFA. To find out more look at the CEFA site in the treasurer.california.gov and appear to possess catc.

Withholding on the Tip Money

Your loyal membership director and your Panama lawyer tend to go with and you will make suggestions by this process.If you want to make use of your business, we’re going to handle the method to you personally. Don’t tend to be withholding out of Forms 592-B otherwise 593 or nonconsenting nonresident (NCNR) member’s tax out of Schedule K-step one (568), Member’s Express cash, Deductions, Credits, etcetera., range 15e on this range. IRC Section 469 (which California incorporates by resource) essentially limits write-offs of couch potato things for the number of income produced by all of the inactive points. Also, loans out of inactive issues are limited to tax attributable to such as issues. These limits is basic applied in the estate or faith level. Obtain the tips for government Mode 8582, Couch potato Pastime Loss Limits, and you may federal Function 8582-CR, Couch potato Interest Credit Restrictions, to learn more about couch potato points loss and borrowing limit regulations.

Our $5 lowest deposit online welcome bonus 888 casinos experience constant audits to have online game equity and you may user shelter. One of the acknowledged licenses you to definitely earn all of our faith are the ones out of the uk Gambling Commission, the fresh MGA, plus the iGaming Ontario or AGCO permit. We advice searching for it provide, especially if you like to play slot games.

Additional Benefits of using Baselane

A property perimeter work for includes payments for your requirements otherwise in your part (along with your family’s should your family members resides to you) simply for next. All the earnings and every other payment to have services performed from the All of us are believed to be away from provide in the United Claims. The sole exclusions to that particular rule is actually discussed lower than Team out of international individuals, teams, or organizations, afterwards, and you can lower than Staff people, earlier. Quite often, bonus earnings obtained from home-based businesses try U.S. source money. Dividend money out of international companies is often overseas origin money.

Moneylines

This type of money is generally exempt away from You.S. taxation or may be subject to a lesser speed from tax. To determine taxation on the nontreaty money, contour the brand new tax from the both the brand new flat 31% speed or even the graduated speed, depending upon perhaps the income is actually effortlessly related to the change or business in america. A nonresident alien is to fool around with Function 1040-Parece (NR) to find and pay projected tax. For those who spend by take a look at, enable it to be payable to “Us Treasury.” If you believe that the notice-a career income try topic simply to U.S. self-a career income tax which is excused from international public protection taxation, consult a certification of Visibility from the SSA. It certificate should determine their exemption from overseas social shelter taxes.

All the information within this publication is not as complete to have citizen aliens because it’s to possess nonresident aliens. Resident aliens are often managed the same as You.S. owners and will discover more details in other Irs publications in the Internal revenue service.gov/Variations. After you make in initial deposit, you receive 80 free spins because the an advantage.

The new faith device provides one to investment gains is actually placed into corpus. 50% of one’s fiduciary charge is actually spent on income and you may 50% to corpus. The new trust obtain $1,five hundred of miscellaneous itemized write-offs (chargeable to earnings), which are subject to both% flooring. The new trustee generated a great discretionary shipping of your own accounting earnings of $17,five-hundred for the faith’s sole beneficiary. Deductible administration costs are those individuals costs that have been sustained in the union to your government of one’s estate or believe who does perhaps not were incurred if your assets just weren’t held such property or believe. Faith expenditures in accordance with additional financing advice and you can financing management fees are various itemized write-offs subject to both% floor.

Suits incentives or deposit matches bonuses tend to match your $5 deposit local casino finest-to a certain the amount, normally at the fifty% otherwise a hundred%, even if almost every other percent could possibly get implement. When you’re this type of offers are typical, it don’t constantly extend because the far that have smaller places, so you could maybe not understand the same improve as with large top-ups. Ruby Chance try an excellent $5 deposit casino you to definitely guarantees the newest greeting added bonus out of C$250. We advice so it gambling establishment because offers more than step 1,one hundred thousand video game and you will a mobile application. Founded within the 2003, it’s one of the recommended $5 deposit casinos inside the Canada. Join All Harbors Gambling establishment and you will discover a-c$step one,five hundred inside extra financing bequeath across the first around three deposits, in addition to 10 100 percent free revolves every day and you can a trial from the successful up to C$step 1,one hundred thousand,000.